Any business requires cash to operate. Cash will constantly move in or out of the business. There is inventory to be purchased, salary or bills to be paid, payments to be received. While all understand the importance of cash in business, it often becomes difficult to determine if the flow of cash in and out of the business is healthy enough to sustain and grow the business.

Without adequate planning and management, it will become difficult to allocate funds for various expenses, invest into the business or pay the bills. Cash flow mismanagement is one of the major reasons why businesses fail. A healthy Cash flow is an important metric measuring the health of the business.

Below are five of the most common mistakes businesses make when forecasting cash flow.

Many businesses do not plan a budget for future cash flow. Not all months/quarters will be similar in terms of sales and expenses. There may be a lean sales period during which additional cash reserves would be needed to manage operations. Before an anticipated period of high sales, sufficient inventory must be purchased leading to additional expense

| 6 Tips for Efficient Cash Flow Management | Tips to Manage Accounts Receivables Efficiently |

Planning this inflow and outflow of revenue and expenses with a budget will help businesses plan ahead to ensure that the cash flow is maintained throughout, and the business is not cash strapped.

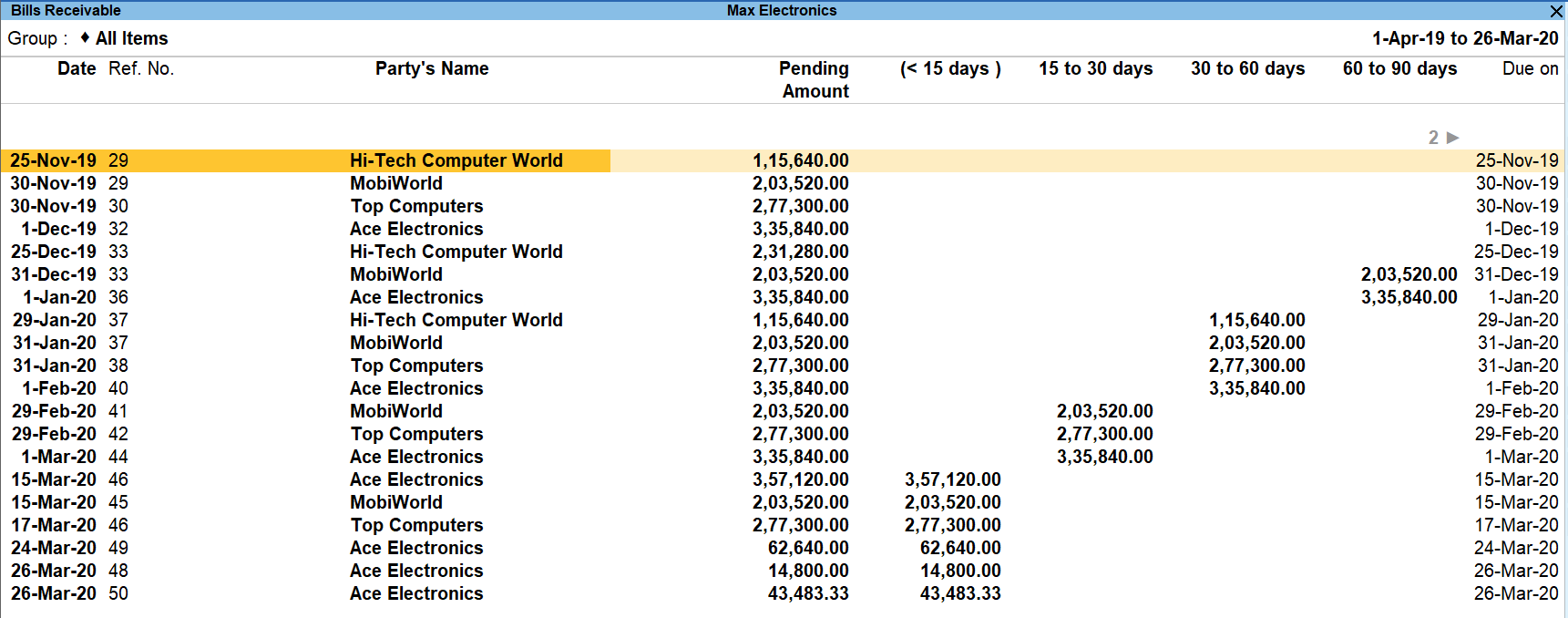

Some (or all) customers may order first and pay later. While this may be a common practise in the industry, if one isn’t proactive in tracking and collecting pending payments, this could leave you severely cash strapped. Payments to employees and vendors may go on hold and you may be unable to purchase inventory for future sales.

Knowing when you will receive payments from customers in advance helps pre-emptively plan the other expenses and activities.

It is thus important to regularly track the pending receivables and set adequate customer policies for receivables and outstanding collection.

In a business, there are times when things do not go as planned. The sales projected for a given period may not happen. A negative event may lead to additional expenses. Different scenarios may play out; however, you may have considered only the best-case scenario while forecasting cash flow.

One must plan for various ‘what-if’ circumstances and create plans for best- and worst-case scenarios. Visualizing this while forecasting your cash flow will prepare you for the negative and positive impacts while managing your cash flow.

In order to generate sales, a business will have to spend money. These could be inventory expenses, marketing expenses or any other customer acquisition cost. However, spending too much money in anticipation of generating sales can lead to a cash crunch. Investing heavily in growth if it leads to a negative cash flow is counterproductive.

Hence, before committing to such investments, the business should consider which expenses are critical and necessary and how they can be phased out in order to not impact the cash flow all at once. It is also important to update projections every time something happens in business that could affect cash flow.

Having a poor process for payment and for tracking of receivables & payables will make cash flow management a complicated process. Business expenses may have a varied payment schedules (salary is to be paid monthly, insurance may be quarterly etc). Similarly, it should be easy for your customers and vendors to commercially transact with you (each may have different credit period set up).

Without an up-to-date accounting software and or payment systems in place, you risk being paid late, missing receivables and not being able to accurately assess your monthly cash flow. Having an automated system that helps you in forecasting gives you an upper hand in managing any cash flow shortages and plan for it in advance.

Mapping out the business strategy using the cash flow forecasting gives the business owner direction and confidence in this pursuit of growth. Cash flow forecasting is one of the most essential and effective tools an organisation can have to ensure business runs smoothly and there is sufficient fund available for continuous growth.