Invoicing is one of the key aspects of every business. No matter, how big or small the business is, you need to issue an invoice for the supplies made to the customers. A small business needs to generate different types of invoices owing to various factors. An industry in which you deal, customer type, regional dependency, compliance requirements, etc. are some of the factors that influence the type of invoice that you need to issue.

For example, based on the compliance requirements, you need to issue an invoice type called “Tax invoice” to a customer located in the same country where your business is located. If the goods are supplied to a customer located in a different country, you need to issue a commercial invoice and may also require you to issue an invoice type known as ‘Export Invoice’.

In this article, we will be listing the different types of invoices that are generated by small businesses.

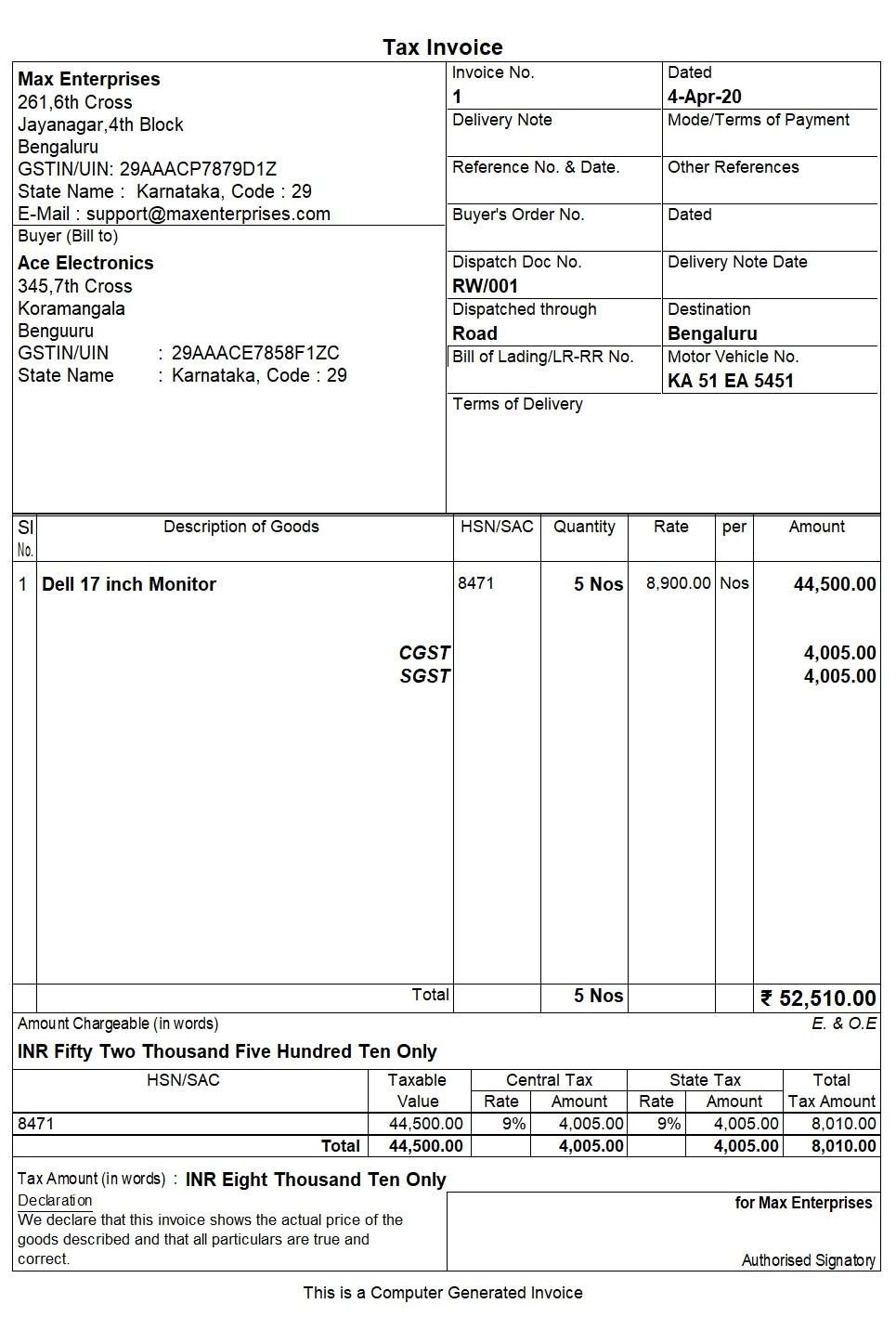

Tax Invoice is an invoice generated and issued by the supplier who is registered under the prevailing statutes such as GST, VAT or any other tax that mandates the business to register and issue such an invoice. This is usually issued when taxable supplies are made. Tax invoices enable the registered customer to claim the tax deductions.

Example: Max Electronics supplies 10 desktops @ 8,900 each to Ace Electronics (Registered). Tax @ 18 is charged on the supply.

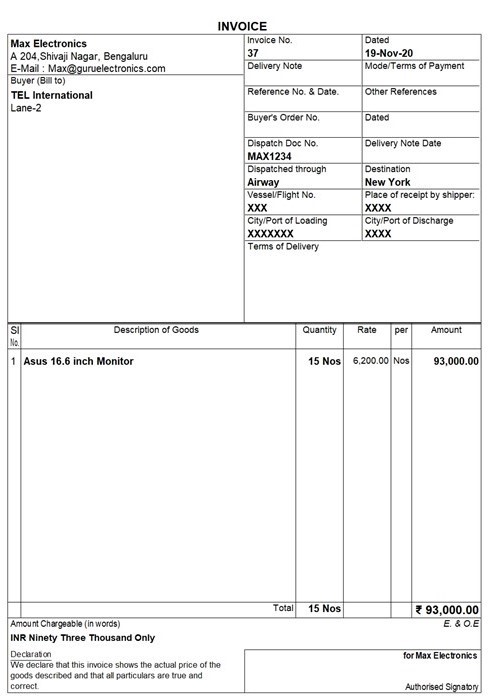

A commercial invoice is a type of invoice that is usually issued when there is no mandate to issue a tax invoice. Also, in the case of exports, the exporter issues the commercial invoice to the importer containing the details of shipment and the payment terms. Sample format commercial invoice generated using TallyPrime shown below.

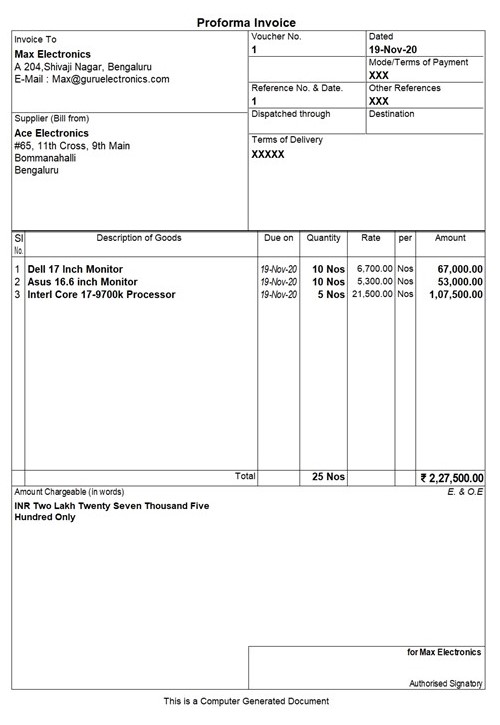

Proforma invoice is a preliminary invoice sent by the buyer to the supplier which provides precise estimates of the goods that are expected to be delivered by the supplier. Sample format of proforma invoice generated using TallyPrime is shown below:

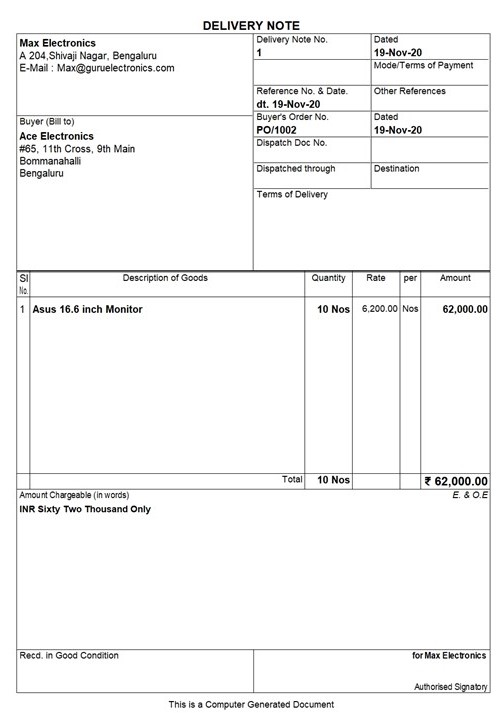

In some cases, the supplier delivers the goods to the customer even before issuing the invoice. In such cases, the supplier issues delivery note and later records the invoice.

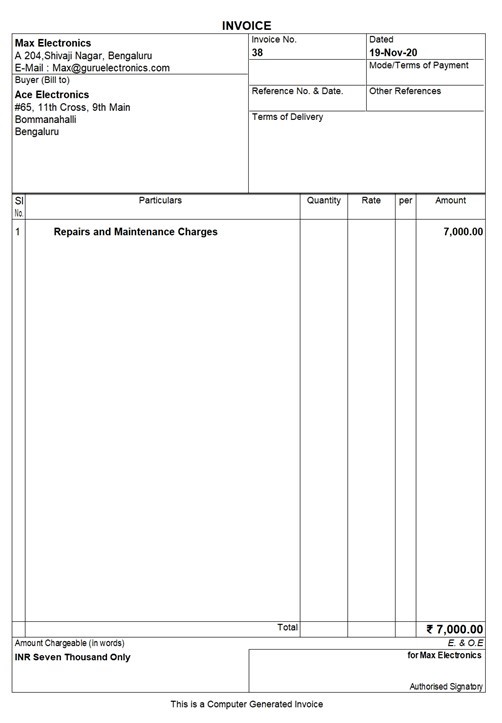

A service invoice is a type of invoice generated for services rendered to the customers. This type of invoice is issued by those businesses who are in the service industry segment. Also, some businesses who deal with inventory issue service invoice for repairs, maintenance etc.

Above are the different types of invoices that are generated frequently by small businesses. If you are using invoicing software or billing software, you need to ensure that such types of invoices are supported and generated by the software.

Today,business management softwarenot only supports you with different types of invoices but also comes with a complete range of features that help you manage your business better.

The following are important components of the invoice:

TallyPrime, all new business management software makes it amazingly simpler to create and record invoices. Optimised invoice components, host of configurations, multiple billing modes and so on.. makes TallyPrime really moulding to your business. Below is the list of invoicing capabilities that comes with TallyPrime:

There are many more things you can do for ease of recording the invoice. Read TallyPrime’s Amazing Invoicing Experience to know more.

Read more on Billing & Invoicing

Credit Terms,Credit Sales,Credit Memo,What is Cash Discount?,Bill of Sale & Purchase Bill,Tips for Choosing the Best Billing and Invoice Software,What is the Difference Between Billing and Invoicing?

e-invoicing

What is e-Invoice in GST, How to Generate e-Invoice in GST, Generate e-Invoice Instantly in TallyPrime, GST Invoicing Software