JIT inventory management is being used by most businesses as an inventory tool to manage optimum inventory levels.

What is just-in-time or JIT inventory management? JIT is also referred to as lean management. JIT means an inventory management system whereby raw materials are ordered just before production but not before that. The objective of JIT is to have minimal inventory in hand so production can begin and then get the raw materials and inventory as the need arises. JIT depends heavily on supplier efficiency and so isn’t an inventory management option for all types of businesses. However, its advantages far outweigh its disadvantages which makes it an inventory management technique to consider.

Quick Tips for Buying the Best Inventory Management Software | 7 Must-Have Features & Functions for Inventory Management Software |

JIT requires you to have the stock before production begins so that it is available to the customer after he places an order. The key is to have the stock just as you require but not way in advance. You must have long-term contracts with your suppliers to ensure JIT works for your business. Of course, you want to factor in the reliability of the suppliers because only those who always fulfill demands and ensure timely delivery must be considered to ensure you get the stock on time with zero delays. JIT requires stellar collaboration because every person involved has to do his job correctly for inventory management to work.

This is important because people need to regularly inform each other and talk to each other to ensure production flow and supply flow are taking place as they should. This dependence will bring the benefits that are associated with JIT and ensure that the process is working smoothly without any bottlenecks. JIT requires constant monitoring and improvement for its continuous success. The aim is always to have sufficient stock to avoid wastage and to ensure product quality while reducing unnecessary costs and expenses along the way. JIT can be implemented in a variety of ways but there are some general steps that every business must take.

JIT starts with the design process whereby the required manufacturing components are determined and identified. The next step is to manage and this is where the roles are defined. The pull step is when the team is explained about the production methods. The next step specifies the supplier list and negotiations also take place. The next step requires refining of controls and identification of inventory requirements. Then the teams are informed about their roles and responsibilities in the JIT process. Once all of these steps are complete, the refining stage takes place whereby the production is made more efficient. The last step is to review and implement after thorough analysis.

JIT inventory management has several advantages as follows.

Leads to higher efficiency

JIT lowers raw material inventories as you are not storing more than required raw materials in your warehouse. It improves inventory turnover ratios which is beneficial for your business. It promotes local sourcing which lowers delivery times and eliminates the need to store extra stock.

Reduces waste

JIT ensures there is minimal waste because you order only what is required. This decreases and eliminates dead stock. It keeps unsold stock to the minimum because you have the inventory you require. It lowers scrap costs as damaged and defective products can be more easily identified.

Decreases expenses and costs

JIT lowers costs as you have lower inventory carrying costs. It lowers how much working capital is required and also lowers the cash expenditure due to lower levels of inventory. It reduces labor costs and due to freeing up of resources, you can direct them elsewhere.

Improves productivity

It cuts down the time required to manage extra inventory. This improves product turnaround. JIT improves the ability to make changes to existing products. It cuts down on production runs as manufacturers become capable of delivering products.

Enhances quality

Businesses can focus on quality which in turn ensures higher customer satisfaction. As the number of defective products will decrease due to them being less prone to damage, it will ensure a better quality of products. JIT helps to lower the number of work-in-progress products too.

Better production

JIT improves production flow because it will lower the number of delays that take place in the supply chain. It reduces the time it takes to manufacture products and shortens the production runs. It lowers scrap levels too.

JIT inventory management has its set of pitfalls as follows.

Heavy reliance on forecasting

A forecast cannot be trusted completely because demand can suddenly arise. This can weaken your business’s ability to meet those demands. In such cases, you can lose your customers and revenue because you won’t be able to satisfy your customers.

Disruption causes delays and inefficiencies

When you use JIT inventory management, you must be ready and prepared for disruption. But sometimes even the most prepared businesses can become paralyzed due to disruptions that directly impact the production process.

Costs and expenses can rise

JIT depends on the constant ordering of inventory to lower inventory costs. This means you will be affected when the prices of raw materials change and this means higher costs when the prices rise above normal. You won’t have much time to shop around which can increase expenses.

Supplier delays stalls production

Even if your supplier always sends inventory on time, it can falter and this can affect the entire production. When this happens you won’t be able to fulfill customer orders as production delays will take place.

Just in time inventory management is useful in a variety of scenarios and a wide range of businesses can use it. It is used in health care sectors to keep their costs and expenses low. Publishing uses JIT, especially authors who publish their books. This ensures they don’t have to deal with the wastage of unsold books. The construction industry uses JIT as storing inventory costs can add up quickly causing a sharp rise in expense. Using JIT enables the industry to minimize materials movement and keep expenses minimum. The automotive industry uses JIT and this was one of the first industries to use JIT. It helps maintain competition.

The apparel industry uses JIT as it must ensure it is aligned with the trends that change rapidly. This allows them to store only what is necessary and reduce unnecessary expenditure on clothes that may be out of fashion. The fast-food industry especially franchises use JIT because it allows them to use fresh ingredients rather than store ingredients for long periods. Retail uses JIT because it allows it to store sufficient inventory thereby cutting costs of storing more than necessary. Another industry where JIT is used is manufacturing where production costs are high and using JIT minimizes inventory to improve efficiency.

As stated earlier, JIT is excellent and many renowned brands have found success with this inventory management method. But JIT is not for every business. If you want to convert to JIT, then there are a few factors you should consider. You should only move forward if all of these requirements are met.

Are your suppliers reliable?

If you have worked with suppliers who have always delivered on time and delivered safely, then you can try JIT. You should be capable of fulfilling orders even when there are delays in the supply chain.

How willing are your employees to change?

JIT requires your employees to understand the process and it requires quite some work from your end as you have to properly train your employees. JIT works best when everyone is on board.

Do you have forecasting abilities?

JIT also depends on the forecasting capabilities of the business. Do you have the tools and the information you need to forecast demand? If yes, then JIT may be for your business.

Can your supplier fulfill demand quickly?

Strong supplier relationships form the basis of JIT's success. If you are working with your suppliers for a long time and they are capable of fulfilling your demand quickly then you can consider JIT.

Can you deal with disruptions?

What if natural disasters take place? Will your supplier be able to fulfill your demands at that time? You need to be capable of dealing with sudden problems that can arise before converting to JIT.

Do you have agile inventory management software?

You need trustworthy inventory management software to manage your inventory with JIT. The software should be capable of giving you insights on trends, stock movement, aging analysis, profitability, re-order status, etc.

TallyPrime is an accounting system with a robust inventory management system. It comes with a host of inventory reports and utilities to manage your business inventories efficiently. It easily adapts to your business needs to give you incredible performance every single day. With its insightful reports, you can make decisions that truly matter and make a difference to your business. TallyPrime has features such as warehouse management, bill of materials, batch-wise and stock-wise management, reorder level, job-work management, and much more. Try TallyPrime today.

Business operations of the service industry vary from business to business. To broadly classify, some businesses are purely into services like consultancies, who generally do not need to manage inventory. On the other side, some businesses are in the service industry, but deal with inventories as well. For example, businesses who are into automobile servicing, whose primary nature is service, but also sell spare parts as a part of overall delivery. No matter what nature of service business you are dealing with, ERP for service industry plays a crucial role in enhancing the efficiency and productivity of your business.

Depending upon the nature of business and the operation, the complexity of managing business varies. If you are purely into a service business, the primary need can be managed billing and receipts from the clients, but there are other areas such as costs, receivables etc. that need to be managed. If you deal with inventory while the primary nature of the business is of service, the needs and complexities get amplified. Here is why ERP for service industry plays an important role.

| What is ERP? | Types of ERP Software System |

Below are some of the key reasons why service industries need an ERP software solution.

Whether you are rendering pure services or into a service segment that requires you to manage inventory, invoicing/billing is a crucial aspect of the business. Using ERP software solution for service industry, you can easily record, track, and manage the invoices. The software solutions that are built for small and medium service business comes with different types of invoices format sand configurations that help you customise the way it works for your business.

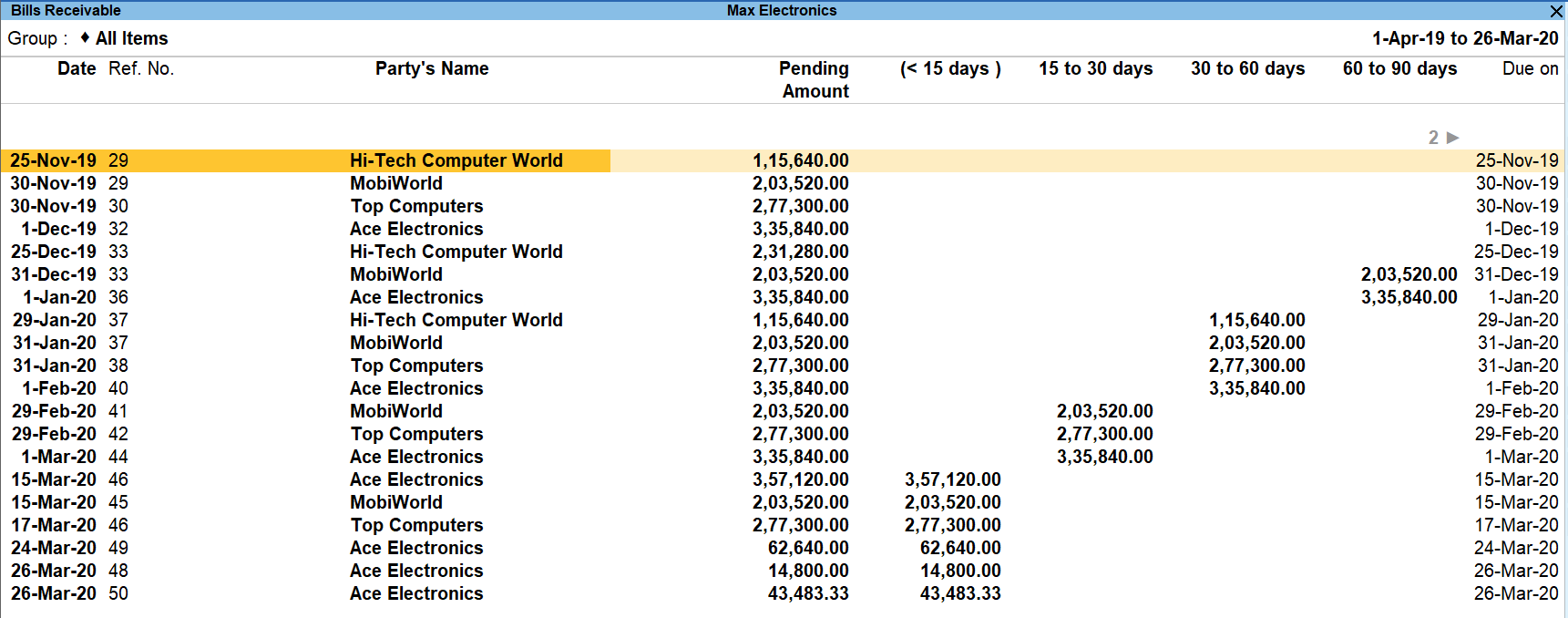

Bills receivables are the invoices that are yet to be paid by your customer. Bills receivables are the key source of cash inflow and contribute hugely towards the working capital requirement of the business. The longer an invoice sits as accounts receivable, it blocks the cash flow and lesser availability of cash to meet your business needs. Using ERP software for services business helps you keep a clean track of receivables, how long they are pending from and help you follow up with your client. Take a look at the best techniques to Manage bills receivable efficiently.

This is extremely crucial for businesses that not just render services, but deal with inventory as well. The complexity here is that some service business uses their own inventories like automobile service business providing repairs and maintenance service uses their spare parts as part of completing the service. On the other end, you have businesses rendering service and use the components/inventories provided by their client like in the case of job work.

To make it even more complex, you might come across situations, where you must manage your stock as well as the stock provided by your client alongside rendering the required service. ERP software solution is not only built with features to manage your books but also includes the features of inventory management software that help you handle such situations easily.

It’s quite a common scenario that service businesses manage the delivery by projects. Here, all the cost, material consumption and revenue attributed to the project to track the revenue. Using ERP software will help you create multiple projects, track cost, including material consumption till the time of issuing an invoice.

Depending upon the tax compliance, such as GST in India,VAT in UAE, Saudi Arabia and other countries, businesses need to be compliant right from generating the tax compliance invoice to managing the books of accounts to filing returns. ERP software solution for service business comes with an inbuilt solution to manage tax requirement of business easily.

TallyPrime is a complete business management software that helps you manage the complete needs of your service business. Using TallyPrime, you can manage invoicing, accounting, inventories, payroll, banking,cash flow and much more in an efficient way. Here are some of the key features of TallyPrime for service business

The robust features of TallyPrime understand your business needs, simplifying the lives of businesses through simple to use software, insightful reports, multi-task capability and much more. This is something that is loved by our 2 Million + customers across the world. Take a free demo and experience yourself.

Any business requires cash to operate. Cash will constantly move in or out of the business. There is inventory to be purchased, salary or bills to be paid, payments to be received. While all understand the importance of cash in business, it often becomes difficult to determine if the flow of cash in and out of the business is healthy enough to sustain and grow the business.

Without adequate planning and management, it will become difficult to allocate funds for various expenses, invest into the business or pay the bills. Cash flow mismanagement is one of the major reasons why businesses fail. A healthy Cash flow is an important metric measuring the health of the business.

Below are five of the most common mistakes businesses make when forecasting cash flow.

Many businesses do not plan a budget for future cash flow. Not all months/quarters will be similar in terms of sales and expenses. There may be a lean sales period during which additional cash reserves would be needed to manage operations. Before an anticipated period of high sales, sufficient inventory must be purchased leading to additional expense

| 6 Tips for Efficient Cash Flow Management | Tips to Manage Accounts Receivables Efficiently |

Planning this inflow and outflow of revenue and expenses with a budget will help businesses plan ahead to ensure that the cash flow is maintained throughout, and the business is not cash strapped.

Some (or all) customers may order first and pay later. While this may be a common practise in the industry, if one isn’t proactive in tracking and collecting pending payments, this could leave you severely cash strapped. Payments to employees and vendors may go on hold and you may be unable to purchase inventory for future sales.

Knowing when you will receive payments from customers in advance helps pre-emptively plan the other expenses and activities.

It is thus important to regularly track the pending receivables and set adequate customer policies for receivables and outstanding collection.

In a business, there are times when things do not go as planned. The sales projected for a given period may not happen. A negative event may lead to additional expenses. Different scenarios may play out; however, you may have considered only the best-case scenario while forecasting cash flow.

One must plan for various ‘what-if’ circumstances and create plans for best- and worst-case scenarios. Visualizing this while forecasting your cash flow will prepare you for the negative and positive impacts while managing your cash flow.

In order to generate sales, a business will have to spend money. These could be inventory expenses, marketing expenses or any other customer acquisition cost. However, spending too much money in anticipation of generating sales can lead to a cash crunch. Investing heavily in growth if it leads to a negative cash flow is counterproductive.

Hence, before committing to such investments, the business should consider which expenses are critical and necessary and how they can be phased out in order to not impact the cash flow all at once. It is also important to update projections every time something happens in business that could affect cash flow.

Having a poor process for payment and for tracking of receivables & payables will make cash flow management a complicated process. Business expenses may have a varied payment schedules (salary is to be paid monthly, insurance may be quarterly etc). Similarly, it should be easy for your customers and vendors to commercially transact with you (each may have different credit period set up).

Without an up-to-date accounting software and or payment systems in place, you risk being paid late, missing receivables and not being able to accurately assess your monthly cash flow. Having an automated system that helps you in forecasting gives you an upper hand in managing any cash flow shortages and plan for it in advance.

Mapping out the business strategy using the cash flow forecasting gives the business owner direction and confidence in this pursuit of growth. Cash flow forecasting is one of the most essential and effective tools an organisation can have to ensure business runs smoothly and there is sufficient fund available for continuous growth.

Invoicing is one of the key aspects of every business. No matter, how big or small the business is, you need to issue an invoice for the supplies made to the customers. A small business needs to generate different types of invoices owing to various factors. An industry in which you deal, customer type, regional dependency, compliance requirements, etc. are some of the factors that influence the type of invoice that you need to issue.

For example, based on the compliance requirements, you need to issue an invoice type called “Tax invoice” to a customer located in the same country where your business is located. If the goods are supplied to a customer located in a different country, you need to issue a commercial invoice and may also require you to issue an invoice type known as ‘Export Invoice’.

In this article, we will be listing the different types of invoices that are generated by small businesses.

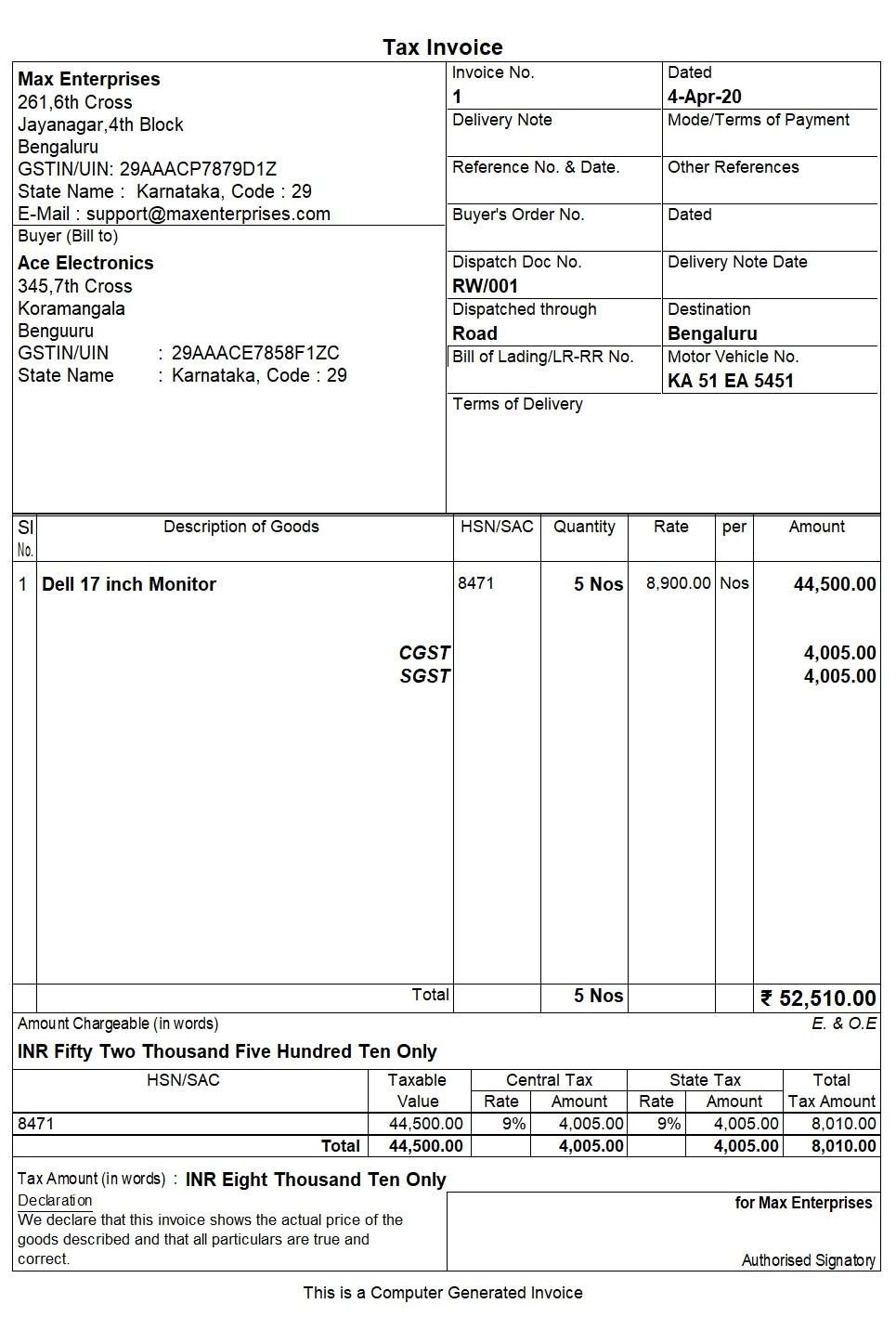

Tax Invoice is an invoice generated and issued by the supplier who is registered under the prevailing statutes such as GST, VAT or any other tax that mandates the business to register and issue such an invoice. This is usually issued when taxable supplies are made. Tax invoices enable the registered customer to claim the tax deductions.

Example: Max Electronics supplies 10 desktops @ 8,900 each to Ace Electronics (Registered). Tax @ 18 is charged on the supply.

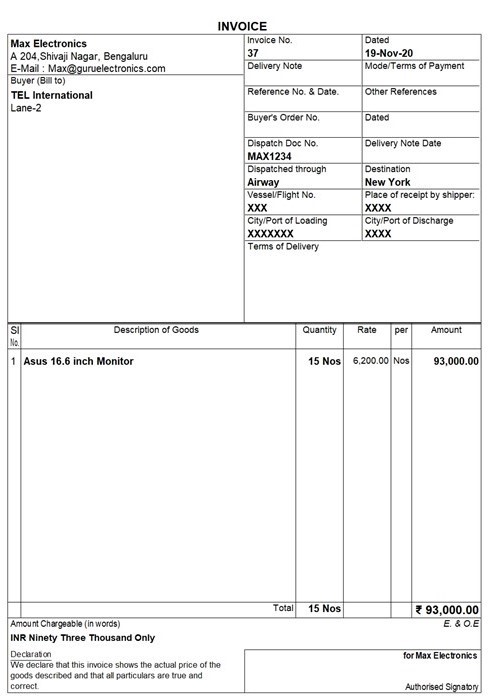

A commercial invoice is a type of invoice that is usually issued when there is no mandate to issue a tax invoice. Also, in the case of exports, the exporter issues the commercial invoice to the importer containing the details of shipment and the payment terms. Sample format commercial invoice generated using TallyPrime shown below.

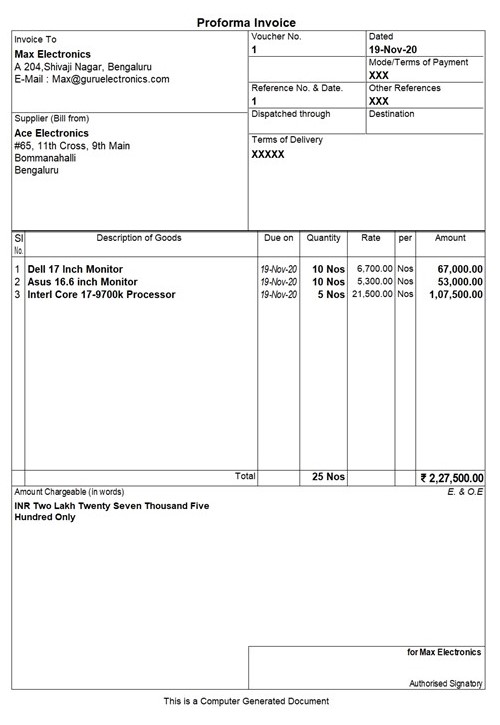

Proforma invoice is a preliminary invoice sent by the buyer to the supplier which provides precise estimates of the goods that are expected to be delivered by the supplier. Sample format of proforma invoice generated using TallyPrime is shown below:

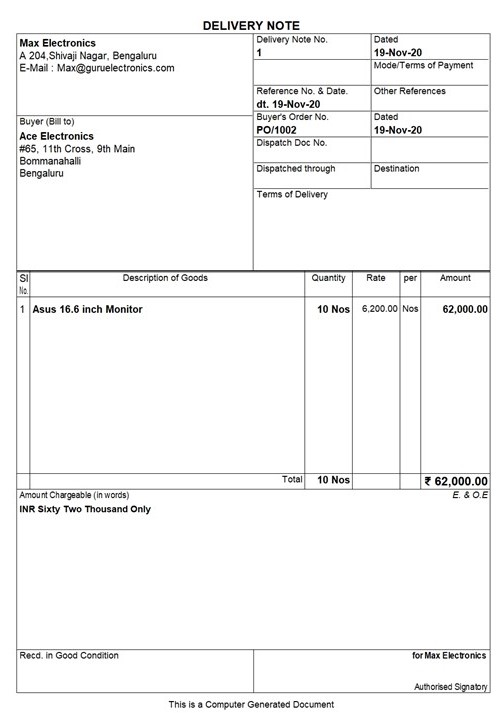

In some cases, the supplier delivers the goods to the customer even before issuing the invoice. In such cases, the supplier issues delivery note and later records the invoice.

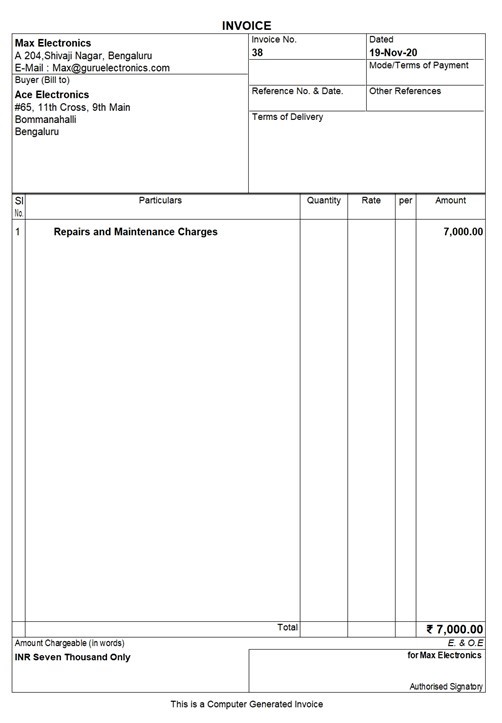

A service invoice is a type of invoice generated for services rendered to the customers. This type of invoice is issued by those businesses who are in the service industry segment. Also, some businesses who deal with inventory issue service invoice for repairs, maintenance etc.

Above are the different types of invoices that are generated frequently by small businesses. If you are using invoicing software or billing software, you need to ensure that such types of invoices are supported and generated by the software.

Today,business management softwarenot only supports you with different types of invoices but also comes with a complete range of features that help you manage your business better.

The following are important components of the invoice:

TallyPrime, all new business management software makes it amazingly simpler to create and record invoices. Optimised invoice components, host of configurations, multiple billing modes and so on.. makes TallyPrime really moulding to your business. Below is the list of invoicing capabilities that comes with TallyPrime:

There are many more things you can do for ease of recording the invoice. Read TallyPrime’s Amazing Invoicing Experience to know more.

Read more on Billing & Invoicing

Credit Terms,Credit Sales,Credit Memo,What is Cash Discount?,Bill of Sale & Purchase Bill,Tips for Choosing the Best Billing and Invoice Software,What is the Difference Between Billing and Invoicing?

e-invoicing

What is e-Invoice in GST, How to Generate e-Invoice in GST, Generate e-Invoice Instantly in TallyPrime, GST Invoicing Software

Purchase is an integral process in the majority of businesses. A manufacturing company purchases the raw materials or services needed to make its products. A retail company buys and sells items, while a wholesaler does the same in bulk. So, in both manufacturing and retail businesses purchasing drives the operation of the business. Therefore, purchasing and all its related processes should be managed for maximum quality and timeliness at the minimum cost. Purchase management is one of the most vital areas of a company’s operation that can directly affect the bottom line. It is essential to understand the objectives of purchasing management to get the best results for the business.

| What is the Difference Between Purchasing and Procurement? |

Purchase management is managing the purchase of the goods and services that the company requires from suppliers and vendors. It is often an integral part of the company’s operations and is an opportunity to improve the efficiency and profitability of the company. The purchase process is usually meant to acquire the raw materials, parts, machinery, equipment, and services that the company requires at the right time and at an advantageous price.

The purchase of these goods and services should aim for the highest quality while also keeping the price as low as possible to enhance the company's profitability. Companies must pay close attention to business purchase management to maximize productivity and profitability. They should also monitor the quality of the procured items to maintain their quality standards. The timelines of purchases are important to ensure that the inputs required for manufacturing are always available in sufficient quantities whenever required. Good purchase management enables companies to stay competitive and achieve economies of scale.

Business purchase management also requires that the company select the right vendor(s) and maintain a good, mutually beneficial relationship with them. While maintaining business relations with regular vendors, the company should also minimize the risks of having too small a group of vendors.

Purchasing is the buying or acquiring goods and services on behalf of a business or company. It is an organized process within a business that ensures that the company acquires the items that it needs, when it needs, and at a reasonable cost. The purchase function of a business is vital in a manufacturing company. The entire manufacturing process is dependent on the purchase of huge amounts of raw materials and input components. The purchasing function in such a company is an ongoing and recurrent activity.

The purchase process often starts with identifying the required items and then finding a supplier for the same. The purchase process then acquires these items in time and perfectly complies with the quality and specifications. Purchase management tries to minimize the money spent on purchases while also maintaining a steady input stream of the required raw materials and components. Purchase management keeps the purchase process efficient, accurate and cost-effective. The size and scale of purchasing may vary depending on the size and type of company. But, the objectives and general process of business purchase management stay the same.

The purchase cycle is the series of steps or processes that the company follows to make a purchase. Every business has its variation of the purchasing cycle, and it starts with the identification of the need and ends with the successful purchase of the goods or service.

The management of the purchasing cycle of the company to obtain the required items with the desired specification and at an attractive price is called purchase management. It aims to improve the efficiency of the company operations by delivering all the requirements in the required time. The best quality goods that perfectly match the requested specifications must be bought. It also aims to save money and improve the profit margins by minimizing the amount spent on purchases. Purchase management is an important process in any business, whether manufacturing, wholesale or retail. Purchasing management governs the purchase strategies of the company for cost management, profit, and efficiency.

Understanding the objectives of purchasing management is imperative to comprehend how the process works. These objectives can be generally applied to different types of companies.

The most common objectives of purchasing management are as follows:

Availability of materials, supplies, and equipment at the minimum possible costs:For manufacturing, wholesale and retail businesses, the supply of items at the right time is vital to the company's operations. If there is any delay in the supply of items, the entire operation of the business could be severely impacted. Business purchase management aims to obtain the supply of goods and services to be available when required. The input cost of purchases impacts the profit margins of the products. Purchase management tries to reduce the cost of production by obtaining items at the lowest possible cost while also maintaining quality.

Enable regular flow of production:A smooth flow of the raw materials and components keeps the company's production line or supply chain going. Good purchase management sustains the regular production flow with the timely and accurate supply of items. This also helps keep productivity at an ideal rate. In a retail business, the steady inflow of items ensures that there is enough stock to be sold. Here, purchase management will also include the right selection of the most appropriate goods in demand.

Increase asset turnover:Purchase of inventory items is a significant investment of cash. This inventory holding is usually listed under assets in the company’s financial reports. When the purchase is inefficient, the company’scash flowsget locked up in purchased inventory. Bad purchase decisions can be very costly for a company. Items that are deadstock lock in cash and also cost money to store. If they are disposed of, it would usually be for a low value. But purchase that keeps inventory at a minimum and is matched by a brisk sales volume leads to efficient inventory management. This asset turnover improves the profitability of the company.

Develop Alternate Sources of Supply:Developing and sustaining good relations with a group of suppliers is ideal. However, overreliance on one supplier(s) from one particular geography is risky. If there are any unforeseen political or natural events in that region, the entire supply of that item would be cut off. If there is a flaw in an item supplied by one vendor, the company can always fall back on the other suppliers. So good purchase management involves reducing risk by maintaining a balanced mix of suppliers from different places. Having more than one supplier is also good to prevent supplier monopoly and keep prices competitive.

Establish Cordial Relations with Suppliers:Companies and their suppliers have a very interdependent relationship. It is good to establish and maintain very cordial relations with all the suppliers. This makes both parties more comfortable accommodating each other’s requests and requirements. When the supplier is confident of an ongoing relationship with recurrent orders, it is easier to negotiate a lower price and more flexible terms. The supplier might also give the company a more generous line of credit and other allowances.

Some of the benefits of a good relationship with suppliers are:

Achieve Close Co-ordination with Other Departments:Purchasing is an activity that impacts the functioning of many other departments in the company. So, purchase management aims to achieve seamless coordination with all the relevant departments and their personnel. This ensures the timely and smooth functioning of the company’s operations. Some of the departments that are directly involved with some of the purchasing functions are:

Production department:This is the principal department that requisitions items for purchase. The production department would create purchase requisitions for items and the detailed specifications, quality, and quantity. They will also specify the timelines within which the items are required. A good relationship between the production department and the purchase department keeps the production process fed with input materials.

Engineering department:The engineering department is in charge of the machinery and equipment used in the company. Since the production of goods depends on machinery, the engineering department has a vital role in the company. The engineering department should work closely with the functions of purchasing management to order any required new equipment and for spares and services required to keep the existing equipment in good condition.

Marketing department:The marketing department advertises the advantages and benefits of products being sold by the company. It is essential that the marketing department keep itself in sync with the actual details of the material used so that they can advertise according to the specifics and quality of the item. A marketing campaign that promises more than it can deliver is bound to fail in the long run and adversely impact the business and its reputation.

Finance department:Purchasing and finance go hand in hand. Purchasing involves paying for goods. So, the finance department has to work together with purchase to use the company’s funds in the best manner to obtain the necessary items, raise money, get the best price and plan the financial aspects of purchasing. The purchase department should negotiate payment terms that are agreeable to the finance department. Both departments need to work together to honor the company's payment obligations to its vendors in a timely manner.

Human resource department:Purchasing is a very people-oriented function. Suppliers and vendor companies are represented by people who negotiate with the personnel in the purchasing department. It is essential to staff the purchasing department with people who have the relevant skills. The human resource department must also support the functions of purchasing management in the ongoing training and skill development of the purchase department people.

Train and develop the personnel:The purchase department personnel will have to meet and do business with different kinds of people. Their people skills and the ability to negotiate while maintaining good relations with the suppliers are essential for the company. So, the purchase department should be attentive to its personnel's adequate training and development. The time and money spent on training the purchase department people will help the company when the purchase department negotiates more favorable deals for the company.

Some of the important aspects of purchase department training include; continual Improvement Process or KAIZEN, quality management, process audit, supplier upgradation or development, Production Part Approval Process (PPAP), and 5S work place management system.

Efficient record maintenance and management reporting:Purchasing involves a lot of paperwork and record-keeping. Impeccable and accurate record-keeping prevents lapses, mismanagement, and fraud in the purchase function. Accurate records, up to date, and easy to understand help management keep a close eye on the purchasing activities. Regular reports that are easy to understand should be a part of the purchase process.

As discussed above, purchasing is a very important function that can improve the efficiency and profitability of a company. The sheer volume of items, suppliers, and purchase orders that a purchase department handles may seem overwhelming. But, using intelligent business management software such as Tally makes it easy to manage, share and coordinate.

Recordkeeping is intuitive, and the data flows through the entire purchase cycle without the need for reentry. The paperwork also flows instantaneously from department to department, eliminating red tape and bottlenecks that may slow down the purchase cycle. It is easy to keep an eye on pending purchase requisitions, purchase orders, and payments using TallyPrime. TallyPrime also secures the purchase process and creates an audit trail for easier management and auditing of records. There is no communication gap between other departments and purchasing when they are all connected by the software.

Using TallyPrime for purchase management gives your purchase department the tools for greater efficiency and productivity. This can directly impact the company’s profit margins and bottom line. Easy record-keeping and process management make work easier for the purchase department and all the departments interacting with the purchase process. The software can also alert you when staple items are running low and need to be reordered, preventing stockouts.